HB chemical思维导图

U350114924

2023-11-14

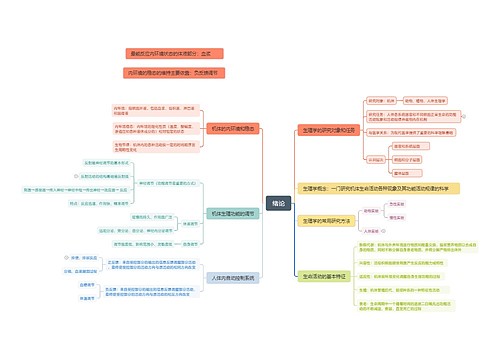

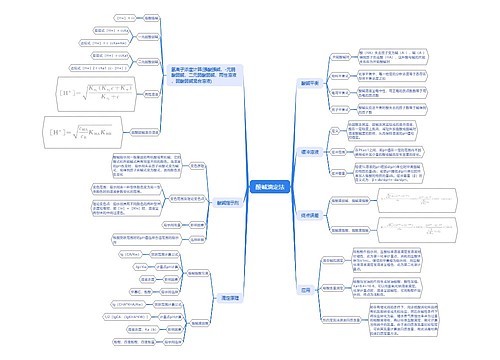

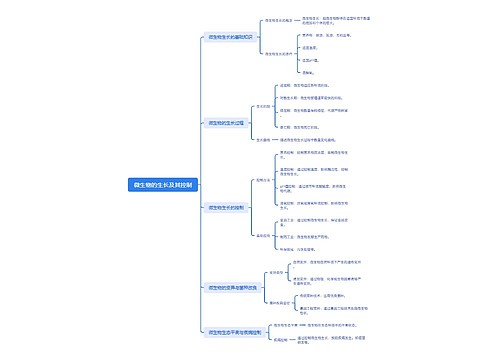

化学品的介绍

树图思维导图提供《HB chemical》在线思维导图免费制作,点击“编辑”按钮,可对《HB chemical》进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:a7a18ad335c6d04510ae48aad56c2d12

思维导图大纲

相关思维导图模版

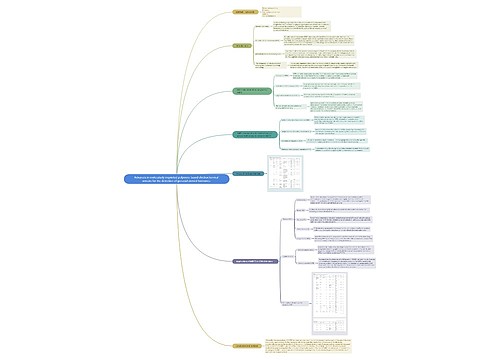

Advances in molecularly imprinted polymers-based electrochemical sensors for the detection of gonadal steroid hormones 思维导图

U877301971

U877301971树图思维导图提供《Advances in molecularly imprinted polymers-based electrochemical sensors for the detection of gonadal steroid hormones 》在线思维导图免费制作,点击“编辑”按钮,可对《Advances in molecularly imprinted polymers-based electrochemical sensors for the detection of gonadal steroid hormones 》进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:84d996ae21e15d8acffa8135e7b7c98c

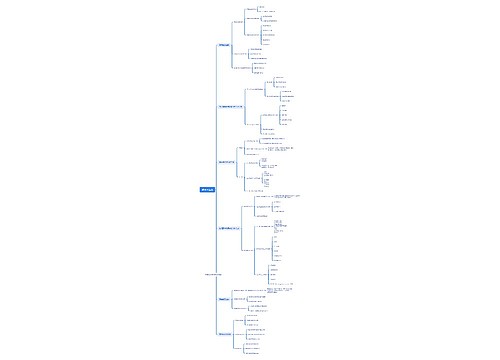

07 生物地球化学性疾病(biogeochemical disease)思维导图

无数

无数树图思维导图提供《07 生物地球化学性疾病(biogeochemical disease)》在线思维导图免费制作,点击“编辑”按钮,可对《07 生物地球化学性疾病(biogeochemical disease)》进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:7b5ea13eb53d7711898c0d1c3a63da99