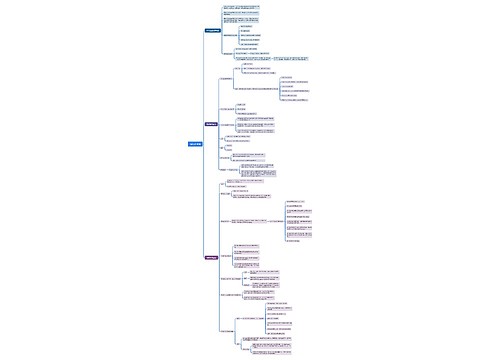

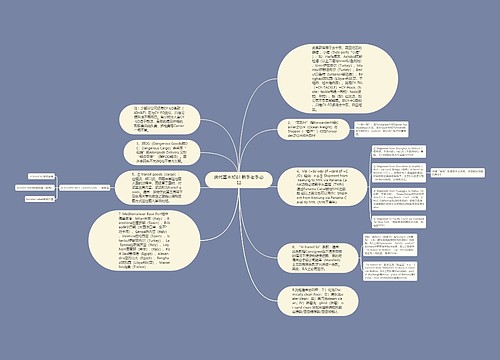

国际结算专业词汇思维导图

篱下浅笙歌

2023-03-10

词汇

专业

结算

国际

the

of

to

or

for

bank

by

see

is

国际贸易法

国际贸易常识

Acceptance

树图思维导图提供《国际结算专业词汇》在线思维导图免费制作,点击“编辑”按钮,可对《国际结算专业词汇》进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:81a73f37e7b55972b063657e2b4627c7

思维导图大纲

相关思维导图模版

国际结算专业词汇思维导图模板大纲

The act of giving a written undertaking on the face of a usance bill of exchange to pay a stated sum on the maturity date indicated by the drawee of the bill, (usually in exchange for documents of title to goods shipped on D/A terms) - see Collections Introduction.

Acceptance Credit

A documentary credit which requires the beneficiary to draw a usance bill for subsequent acceptance by the issuing bank or the advising bank or any other bank as the credit stipulates - see Documentary Credits.

Accommodation Bill

In the context of fraud, a bill drawn without a genuine underlying commercial transaction.

Accountee

Another name for the applicant/opener of a documentary credit i.e. the importer = the person for whose account the transaction is made.

Advice of Fate

The Collecting Bank informs the Remitting Bank of non- payment/non-acceptance or (for D/A bills) of acceptance and the bill maturity date - see Handling Import Collections.

Advising

Act of conveying the terms and conditions of a DC to the beneficiary. The advising bank is the issuing bank agent, usually located in the beneficiary country - see Export - DC Advising. Advising also involves authentication i.e. advising bank should take reasonable care to check the apparent authenticity of the credit (ICC UCC 500 Art 7).

Amendment

Alteration to the terms of a DC; amendments must stem from the applicant, be issued and advised to the beneficiary; the beneficiary has the right to refuse an amendment if the credit is irrevocable - see Amendments to DCs.

Applicant

One who applies to his bank to issue a documentary credit; in the majority of credits issued the applicant is an importer of goods

Avalise

The act by a bank in guaranteeing payment of a bill of exchange or promissory note by endorsing the reverse with the words good per aval and signed by the bank, or by the issuance of a separate guarantee.

B

Back-to-Back Credit

A credit issued against the security back of another credit (master credit) on the understanding that reimbursement will stem from documents eventually presented under the first credit (master credit) issued - see Special DCs. It follows therefore that each side of a B/B transaction covers the shipment of the same goods.

Beneficiary

A payee or recipient, usually of money. A party in whose favour a documentary credit is established, usually the exporter.

Bill for Collection (BC)

Document(s) or cheque submitted through a bank for collection of payment from the drawee.

Bill of Exchange (B/E)

An unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at fixed or determinable future time a sum certain in money to or to the order of a specified person, or to bearer.

Bill of Lading (B/L)

A receipt for goods for shipment by sea. It is a Document of Title: see Documents.

Bill Receivable (BR)

Bills which are financed by the receiving branch, whether drawn under a DC or not, are treated as BRs by both the remitting branch and the receiving branches - see Bills Receivable.

Blank Endorsed

When a bill of lading is made out to order or shipper order and the shipper has signed on the back of it, it is said to be blank endorsed. The bill of lading then becomes a bearer instrument and the holder can present it to the shipping company to take delivery of the goods.

C

Carrier

Person or company undertaking for hire the conveyance of goods e.g. shipping company

Case of Need

Agent nominated by a principal, to whom the collecting bank may refer in specified circumstances concerning collections - see the sections on Collections.

Chaser

Reminder sent by the collecting (or DC issuing) bank to the importer, repeating a request for payment - see Handling Import Collections.

Clean

Used to describe a draft/cheque with no shipping documents - see Collections Introduction. Used to describe a bill of lading without clauses that expressly declare a defective condition of the goods or the packing.

Clean Bill Purchased

A collection bill purchased with no shipping Purchase documents - see Financing Export Collections.

Clean Bill Receivable (CBR)

BR (Bill Receivable) with no shipping documents. The term is more often used for non-trade bills such as travellers cheques.

Clean Collection

A draft with no documents Collection attached - see Collections ?Introduction?

Clean Import Loan (CIL)

A loan granted to an importer for payment of import bills, without the Bank having any claim to the goods.

Collection Bank

Bank in the drawee country that is instructed to collect payment from the drawee - see Collections Introduction.

Collection Order

Form submitted, with documents, to the Remitting/Negotiating Bank by an exporter with his instructions - see Collections ?Introduction.

Confirming

Act of a bank other than the issuing bank assuming the liability for payment, acceptance or negotiation of correctly presented documents under a DC - see Confirmation of DCs.

Consigment

Shipment of goods.

Consignee

The person/company/bank to whom the goods are delivered - usually the importer or the Collecting Bank - see Handling Import Collections.

Consignor

Also called shipper, is the person/company who sends goods by ship, by land or air.

Contingent Liability

A liability that arises only under specified conditions, e.g. when a bank opens a DC it incurs an obligation to make a future payment on condition that the terms are fully met.

D

DC Bills

Bills drawn under documentary credits.

Deferred Payment Credit (DPC)

A DC which allows the nomination of a bank, or the issuing bank to effect payment against stipulated documents at a maturity date as specified or determinable from the wording of the credit.

Demurrage

A charge made by a shipping company or a port authority for failure to load or remove goods within the time allowed.

Discounting

Act of purchasing an accepted usance bill of exchange at an amount less than the face value.

Discrepancy

Any deviation from the terms and conditions of a DC, or the documents presented thereunder, or any inconsistency between the documents themselves - see Negotiation under DCs.

Dishonour

Non-payment or non-acceptance.

Documentary Credit (DC)

A conditional undertaking by a bank to make payment, often abbreviated to credit. More precisely, it is a written undertaking by a bank (issuing bank) given to the seller (beneficiary) at the request of the buyer (applicant) to pay a sum of money against presentation of documents complying with the terms of the credit within a set time limit.

Documents

The characteristics and importance of the various documents associated with Import/Export operations are explained and illustrated in Deciding on Documents.

Documents Against Acceptance (D/A)

Instruction for commercial documents to be released to the drawee on acceptance of the Bill of Exchange - see Collections ?Introduction.

Documents Against Payment (D/P)

Instruction for documents to be released to the drawee only on payment - see Collections ?Introduction.

Documents of Title

Documents that give their owner the right to the goods, i.e. Bill of Lading.

Draft

Bill of exchange issued by an exporter and submitted to his bank for collection, or under a DC - usually submitted with attached shipping documents - not to be confused with a bankers draft which is sometimes used as a vehicle for reimbursement.

Drawee

Party on whom a bill is drawn and the one to whom presentation is to be made according to the collection order - the importer (NB: for DC bills, the drawee is usually the DC issuing bank).

Drawer

The exporter, who draws the Bill of Exchange/draft which in itself is a claim for payment.

Due Date

Maturity date for payment

查看更多

相似思维导图模版

首页

我的文件

我的团队

个人中心