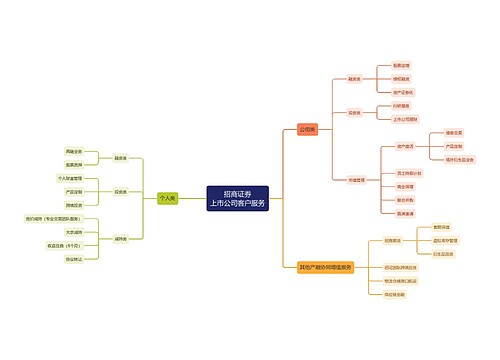

金融服务专题思维导图

U284521049

2024-12-04

债务融资不同

货币政策

预算盈余

金融服务专题内容详述

树图思维导图提供《金融服务专题》在线思维导图免费制作,点击“编辑”按钮,可对《金融服务专题》进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:fd82405c467dc8e2c990fa46d21583d1

思维导图大纲

相关思维导图模版

金融服务专题思维导图模板大纲

Ch0 Introduction to Debt Financing vs.Equity Financing

1.Overview of Debt Financing and Equity Financing

Debt Financing

<a id="OLE_LINK1"></a>• Debt financing involves borrowing money that must be repaid with interest over a specified period, typically through loans or bonds. It includes fixed repayment schedules and interest rates, and it does not dilute ownership of the company.

债务融资指的是借款,必须在特定时期内带利息偿还,通常是通过贷款或债券。它包括固定的还款时间表和利率,而且不会稀释公司的所有权。

• Common forms of debt financing include bank loans, corporate bonds, and lines of credit.

债务融资的常见形式包括银行贷款、公司债券和信用额度。

Equity financing

<a id="OLE_LINK2"></a>• Equity financing involves selling shares of a company to investors to raise capital, resulting in a transfer of ownership stake.

股权融资涉及向投资者出售公司股票以筹集资金,从而导致所有权股权的转移。

• Unlike debt financing, equity financing does not create a debt obligation for the company, as investors become shareholders with no repayment required.

与债务融资不同,股权融资不会给公司带来债务义务,因为投资者成为股东后无需偿还债务。

• Equity financing typically provides long-term capital that does not need to be repaid, allowing companies to invest in growth without immediate financial pressure.

股权融资通常提供不需要偿还的长期资本,使企业能够在没有立即财务压力的情况下投资于增长。

2.Differences Between Debt Financing and Equity Financing

Ownership Structure

• Debt financing does not dilute ownership; lenders have no ownership stake, only a right to interest and principal repayment.

债务融资不会稀释所有权;贷款人没有所有权股份,只有利息和本金偿还的权利。

• Equity financing involves selling shares of the company, which dilutes ownership and gives investors a stake in the company's profits and decision-making.

股权融资涉及出售公司的股票,这会稀释所有权,让投资者在公司的利润和决策中占有一席之地。

•

•

•

•

•

Ch1 Why Study Money, Banking and Financial Markets?

1.1 Why Study Financial Markets?

•

金融市场是指资金从可用资金过剩的人和公司转移到需要资金的人和公司的市场。

The Bond Market and Interest Rates

• A

证券(金融工具)是对发行人未来收入或资产的债权。

• A

债券是一种在特定的承诺期限内定期付款的债务担保。

• An

利率是指借款成本或租赁资金的价格。

The Stock Market

•

普通股代表了一个公司的所有权份额。

•

一股股票是对公司剩余收益和资产的一种所有权。

1.2 Why Study Financial Institutions and Banking?

•

金融中介机构:向储蓄的人借资金,进而向需要资金的人贷款的机构。

– Banks: accept deposits and make loans .

银行:接受存款和发放贷款。

– Other financial institutions: insurance companies, finance companies, pension funds, mutual funds and investment companies.

其他金融机构:保险公司、金融公司、养老基金、共同基金和投资公司。

•

金融创新:新的金融产品和服务的开发

– Can be an important force for good by making the financial system more efficient

通过使金融系统更高效,可以成为一股重要的有益力量

– E-finance: the ability to deliver financial services electronically

电子金融:以电子提供金融服务的能力

•

declines in asset prices and the failures of many financial and nonfinancial firms.

金融危机:金融市场的重大混乱,其特征是资产价格的急剧下跌,以及许多金融和非金融公司的倒闭。

1.3 Why Study Money and Monetary Policy?

• Evidence suggests that

有证据表明,货币,被定义为任何被普遍接受为支付商品或服务或偿还债务的任何东西,在产生商业周期中起着重要的作用。

• Recessions (unemployment) and expansions affect all of us.

经济衰退(失业)和经济扩张影响着我们所有人。

• Monetary theory ties changes in the money supply to changes in aggregate economic activity and the price level.

货币理论将货币供应的变化与总体经济活动和价格水平的变化联系起来。

Money, Business Cycles, and Inflation

•

总价格水平是一个经济中商品和服务的平均价格

• A continual rise in the price level (inflation) affects all economic players.

价格水平的持续上升(通货膨胀)影响所有经济参与者。

• Data show a connection between the money supply and the price level.

数据显示货币供应和价格水平之间的联系。

Money and Interest Rates

•

利率是货币的价格。

• Prior to 1980, the rate of money growth and the interest rate on long-term Treasury bonds were closely tied .

在1980年之前,货币增长率与长期国债利率密切相关。

• Since then, the relationship is less clear, but the rate of money growth is still an important determinant of interest rates.

从那时起,关系不太清楚,但货币增长率仍然是利率的一个重要决定因素。

Fiscal Policy and Monetary Policy

•

货币政策是指管理货币供应和利率。

– Conducted in the United States by the Federal Reserve System (Fed) .

由美国联邦储备系统(Fed)实施。

• Fiscal policy deals with government spending and taxation.

财政政策涉及政府支出和税收。

–

预算赤字是指某一特定年份的支出超过收入。

–

预算盈余是指某一特定年份的收入超过支出。

– Any deficit must be financed by borrowing.

任何赤字都必须通过借款来提供资金。

The Foreign Exchange Market

• The

外汇市场:资金从一种货币转换为另一种货币。

• The foreign exchange rate is the price of one currency in terms of another currency.

外汇汇率是一种货币对另一种货币的价格。

• The foreign exchange market determines the foreign exchange rate.

外汇市场决定了外汇汇率。

1.4 Why Study International Finance

• Financial markets have become increasingly integrated throughout the world.

全球各地的金融市场已经日益一体化。

• The international financial system has tremendous impact on domestic economies:

国际金融体系对国内经济有着巨大的影响:

– How a country’s choice of exchange rate policy affect its monetary policy?

一个国家的汇率政策的选择如何影响其货币政策?

– How capital controls impact domestic financial systems and therefore the performance of the economy?

资本控制如何影响国内金融体系,从而影响经济的表现?

– Which should be the role of international financial institutions like the IMF?

像国际货币基金组织这样的国际金融机构的角色?

The International Financial System

• Financial markets have become increasingly integrated throughout the world.

世界各地的金融市场日益一体化。

• The international financial system has tremendous impact on domestic economies:

国际金融体系对各国经济的影响巨大:

– How a country’s choice of exchange rate policy affect its monetary policy?

一国汇率政策的选择如何影响其货币政策?

– How capital controls impact domestic financial systems and therefore the perfor

mance of the economy?

资本管制如何影响国内金融体系,进而影响经济表现?

– Which should be the role of international financial institutions like the IMF?

像国际货币基金组织这样的国际金融机构应该扮演什么样的角色?

1.5 Money, Banking, and Financial Markets and Your Career

Understanding monetary policy may help you predict when interest rates will rise or fall, help you make decisions about whether it is better to borrow now or to wait until later, know how banks and other financial institutions are managed which may help you get a better deal when you need to borrow from them and may enable you to make better investment decisions, whether for yourself or for the company you work for.

了解货币政策可以帮助你预测利率何时上升或下降,帮助你决定是现在借钱还是等到以后再借,知道银行和其他金融机构是如何管理的,这可能有助于你在需要从他们那里借钱时得到更好的交易,并可能使你做出更好的投资决策,无论是为你自己还是为你工作的公司。

1.6 How We Will Study Money, Banking, and Financial Markets

• A simplified approach to the demand for assets

对资产需求的简化方法

• The concept of equilibrium

均衡的概念

• Basic supply and demand to explain behavior in financial markets

解释金融市场行为的基本供给和需求

• The search for profits

对利润的追求

• An approach to financial structure based on transaction costs and asymmetric information

基于交易成本和信息不对称的财务结构研究

• Aggregate supply and demand analysis

总供给和需求分析

Ch2 An Overview of the Financial System

2.1 Financial System -- functions

2.2 Financial System -- structure

• Debt and Equity Markets 债务市场和股权市场

• Primary and Secondary Markets 一级市场和二级市场

– Investment Banks underwrite securities

投资银行承销证券

– Brokers and dealers work in secondary markets

经纪人和交易商在二级市场工作

• Exchanges and Over-the-Counter (OTC) Markets 交易所和场外交易市场

– Exchanges: NYSE, Chicago Board of Trade

交易所:纽约证券交易所,芝加哥交易所

– OTC Markets: Foreign exchange, Federal funds.

场外交易市场:外汇、联邦基金。

• Money and Capital Markets 货币市场和资本市场

– Money markets deal in short-term debt instruments

货币市场交易的是短期债务工具

– Capital markets deal in longer-term debt and equity instruments

资本市场交易的是长期债务和权益工具

2.3 Financial System -- instruments

• Money market instrument:

United States Treasury Bills 美国国库券

Negotiable Certificate of Deposit 可转让银行定期存单

Commercial Paper 商业票据

Repurchase Agreements 回购协议(一种短期融资工具)

Federal Funds 联邦基金

• Capital market instrument:

Stocks 股票

Mortgages 抵押贷款

Corporate Bonds 公司债券

U.S. Government Securities 美国政府证券

U.S. Government Agency Securities 美国政府机构证券

State and Local Government Bonds 州和地方政府债券

Consumer and bank Commercial Loans消费贷款和银行商业贷款

2.4 Financial System -- internationalization

• Foreign Bonds外国债券

sold in a foreign country and denominated in that country’s currency

在外国出售并以该国货币计价

• Eurobond 欧洲债券

bond denominated in a currency other than that of the country in which it is sold

以出售国以外的货币计价的债券

• Eurocurrencies 欧洲货币

foreign currencies deposited in banks outside the home country

存在本国以外银行的外币

– Eurodollars: U.S. dollars deposited in foreign banks outside the U.S. or in foreign branches of U.S. banks

欧洲美元:存放在美国以外的外国银行或美国银行的外国分支机构的美元

• World Stock Markets世界股票市场

2.5 Financial System -- types of intermediaries

2.6 Financial System -- Function of Financial Intermediaries: Indirect Finance

• Lower transaction costs 降低交易成本

– Economies of scale 规模经济

– Liquidity services 流动性服务

• Reduce the exposure of investors to risk 减少投资者的风险敞口

– Risk Sharing (Asset Transformation) 风险分担(资产转换)

– Diversification 多样化经营

• Deal with asymmetric information problems 处理信息不对称问题

– (before the transaction)

(交易前)逆向选择:尽量避免选择有风险的借款人。

– (after the transaction)

(交易后)道德风险:确保借款人不会从事妨碍其偿还贷款的活动。

2.7 Financial System -- function of Financial Markets

• Perform the essential function of channeling funds from economic players that have saved surplus funds to those that have a shortage of funds.

发挥把资金从储蓄富余的经济主体向资金短缺的经济主体转移的重要作用。

• Direct finance: borrowers borrow funds directly from lenders in financial markets by selling them securities.

直接融资:借款人在金融市场上通过向出借人出售证券直接向出借人借款。

• Promotes economic efficiency by producing an efficient allocation of capital, which increases

production.

通过资本的有效配置提高经济效率,从而增加生产。

• Directly improve the well-being of consumers by allowing them to time purchases better.

通过让消费者更好地选择购买时间,直接改善消费者的福祉。

2.8 Financial System -- regulation

• Why do financial services scandals happen?

金融服务丑闻为什么会发生?

• To ensure the soundness of financial intermediaries:

确保金融中介机构稳健运作:

– Restrictions on entry (chartering process).

入境限制(租船程序)

– Disclosure of information.

信息披露

– Restrictions on Assets and Activities (control holding of risky assets).

对资产和活动的限制(控制持有风险资产)

– Deposit Insurance (avoid bank runs).

存款保险(避免银行挤兑)

– Limits on Competition (mostly in the past):

竞争限制(主要在过去):

• Branching

• Restrictions on Interest Rates 利率限制

• The cost of and problems with financial regulation

金融监管的成本和问题

Ch8 An Economic Analysis of Financial Structure

8.1 Basic Facts About Financial Structure Throughout the World

8.2 Transaction Cost

8.3 Asymmetric Information: Adverse Selection And Moral Hazard

查看更多

相似思维导图模版

首页

我的文件

我的团队

个人中心