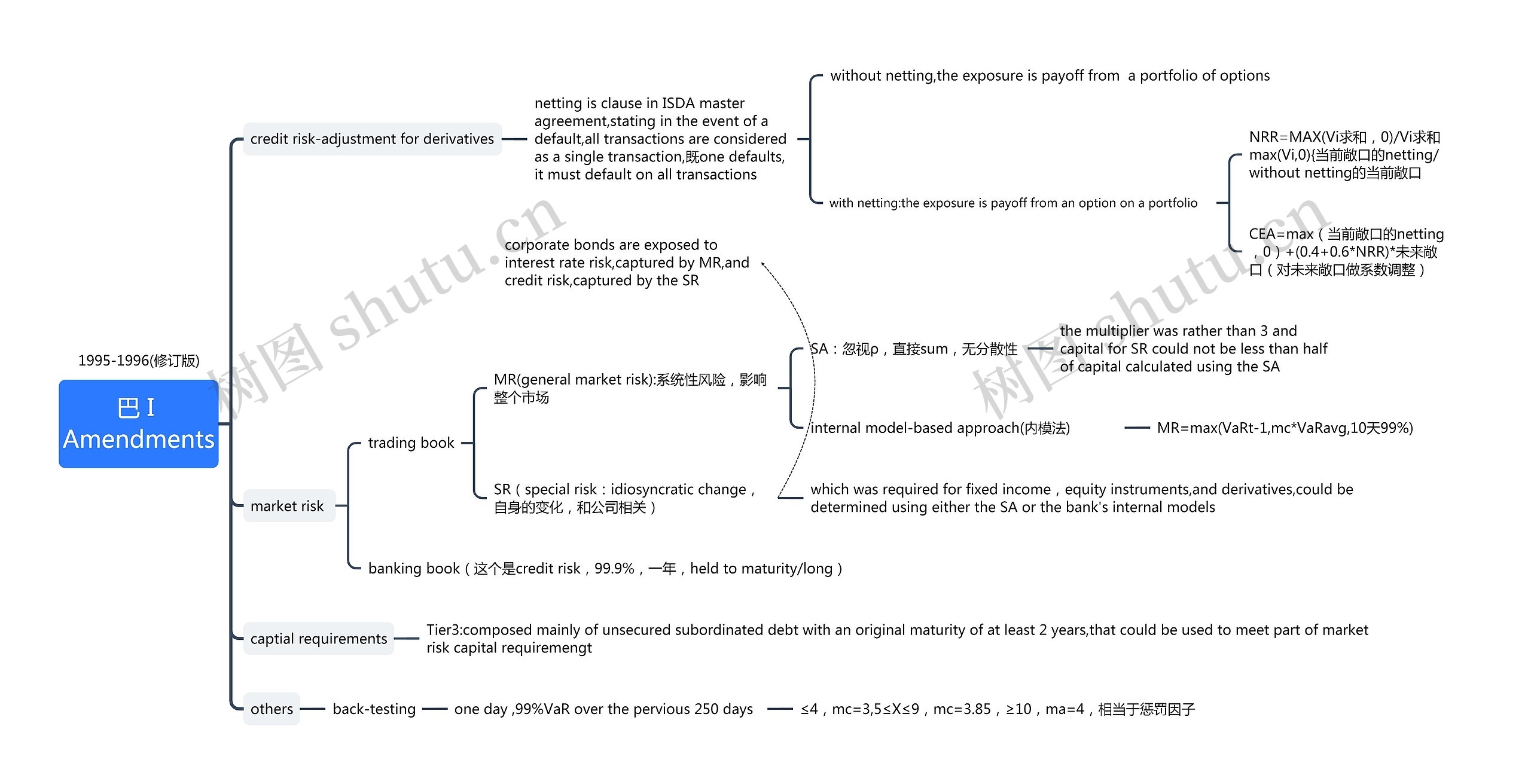

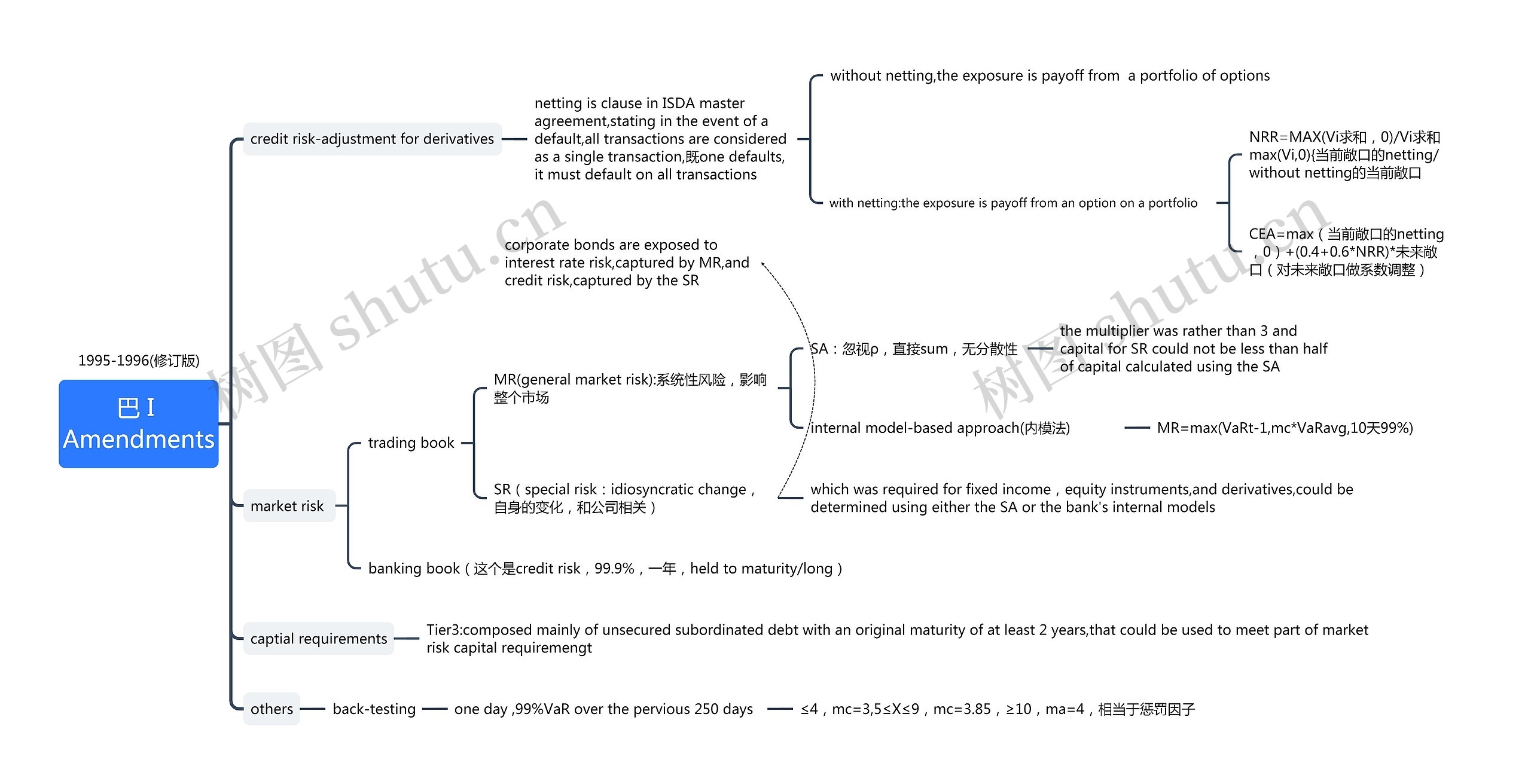

巴 I Amendments思维导图

U131211398

2023-04-09

巴 I Amendments修正案

树图思维导图提供《巴 I Amendments》在线思维导图免费制作,点击“编辑”按钮,可对《巴 I Amendments》进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:0d77cdbd29df3d57efb69126bcc4eab9

巴 I Amendments修正案

树图思维导图提供《巴 I Amendments》在线思维导图免费制作,点击“编辑”按钮,可对《巴 I Amendments》进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:0d77cdbd29df3d57efb69126bcc4eab9